The American Rescue Plan Act that passed in March 2021 is the third federal relief package and totals $1.9 trillion. It includes a wide range of benefits to create a path to recovery from the economic and health impacts of the COVID-19 pandemic. The act is the most recent federal relief package to pass Congress and is one part of President Biden’s Build Back Better plan, which includes the American Families Plan and American Jobs Plan that will be considered by Congress. It comes one year after the initial relief package of $2.2 trillion allocated through the CARES Act. The new plan extends some provisions from the previous relief packages, provides direct aid to states and localities and creates changes to tax policy.

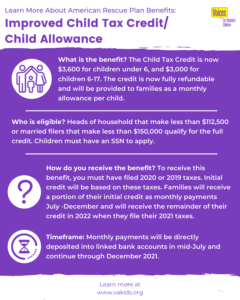

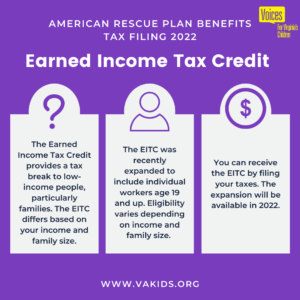

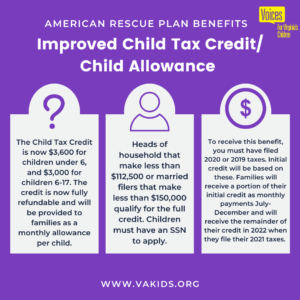

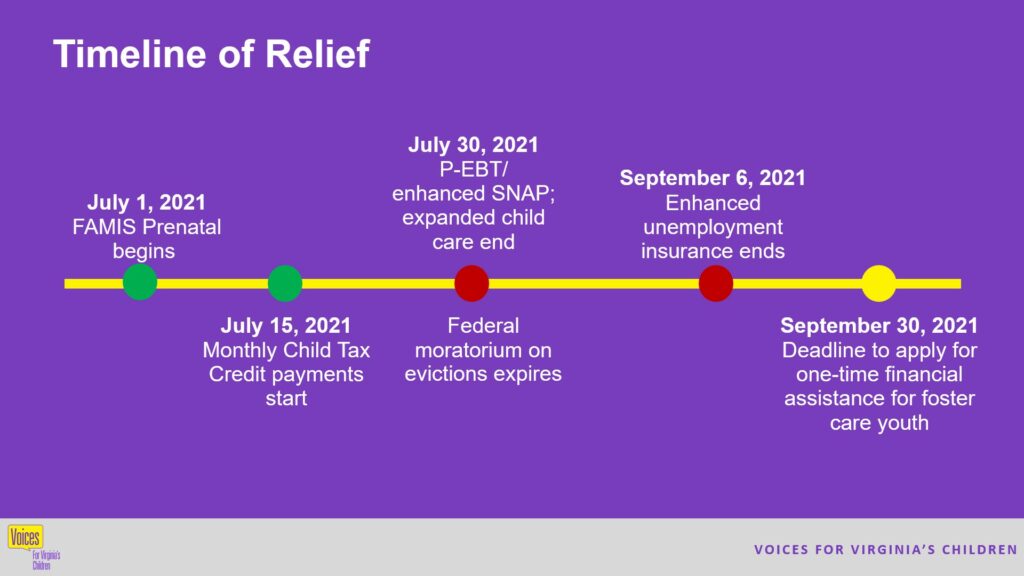

Check out shareable graphics explaining all of the American Rescue Plan benefits and additional resources for information, below.

Toolkit:

Help share these blogs and images to spread awareness of upcoming and current benefits of the American Rescue Plan.

Be sure to tag us @vakids when you do.

Tax Assistance Resources:

Child Tax Credit Portal: https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021

- Use to opt out of advance payments

- Submit information if you are not required to file taxes

- Coming soon: submit bank account changes, address changes and update household membership/new baby

- Easiest to use on mobile device to take steps to verify identify

IRS Free File: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

- For people who have an income of $72,000 or less.

- Public-private partnership to offer online free federal filing. State preparation fees may apply but have to be listed on website so they cannot charge fees without consent.

Volunteer Income Tax Assistance (VITA)

- Free in-person assistance for people making less than $57,000 a year, people with disabilities, and limited English-speaking taxpayers

- People can locate a VITA near them here: https://irs.treasury.gov/freetaxprep/

- Local Community Action Agencies and United Ways can also help file taxes: https://www.vacap.org/free-tax-prep-news/

GetYourRefund.org

- https://www.getyourrefund.org/en

- Free online filing assistance for people with incomes below $66,000. Website is also available in Spanish.

Low Income Taxpayer Clinics (LITCs)

- Assists people who have disputes with the IRS (such as not receiving a credit they are entitled to or issues with audits). They specifically serve people whose income is below 250% of the federal poverty line and can provide information about taxpayer rights and responsibilities in different languages. Services are offered for free or a small fee.

- https://www.taxpayeradvocate.irs.gov

VA CAP Tax Filing Resources: https://www.vacap.org/free-tax-prep-news/

Other Resources:

Learn more about the details of different benefits and how to receive assistance by listening to this recorded webinar:

This webinar is especially useful for individuals working in roles as family support specialists, parent liaisons, social workers, parent engagement specialists and others.