On September 12, the U.S. Census Bureau released the findings of three reports estimating income, poverty, and health insurance coverage in the United States. According to the Supplemental Poverty Measure (SPM), the overall rate of poverty increased from 7.8 percent in 2021 to 12.4 percent in 2022. The most dramatic change, however, was the sharp increase in child poverty.

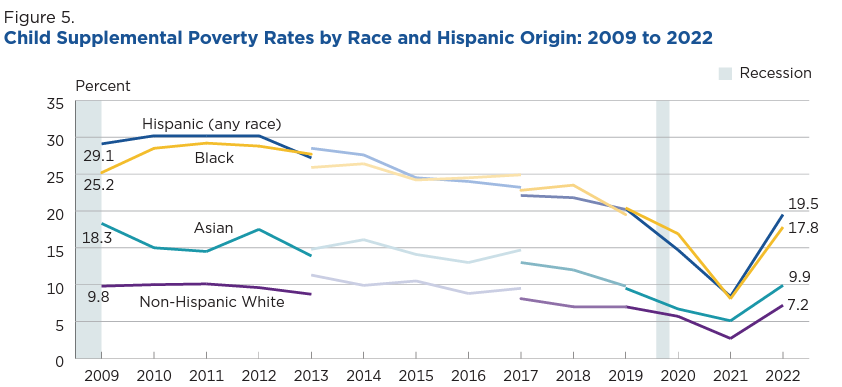

The Supplemental Poverty Measure (SPM) indicates that poverty rates increased for all groups of children, but Black and Hispanic children continued to experience disproportionately high rates of poverty. 17.8 percent of Black children and 19.5 percent of Hispanic children experienced poverty in 2022, compared to 7.2 percent of non-Hispanic white children.

U.S. Census Bureau, Poverty in the United States: 2022

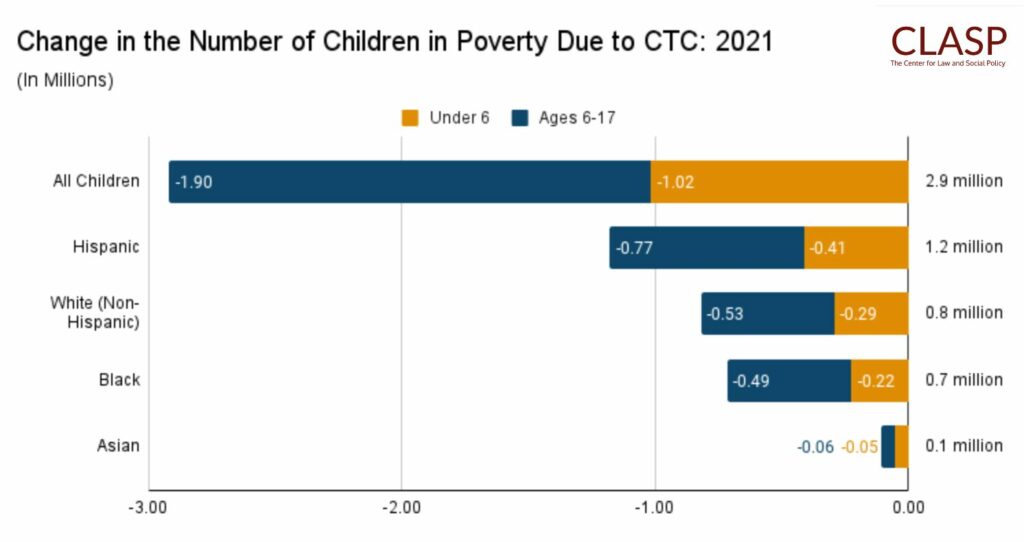

In 2021, as part of the American Rescue Plan, the expanded Child Tax Credit (CTC) was implemented to provide advanced monthly payments at an increased amount to families to help them put food on their tables and pay for their day-to-day needs.

The CTC was fully refundable, which means it was available to families who had no reported earnings or federal income tax liability. And the expanded CTC worked—it kept 2.9 million children of out poverty, cutting the child poverty rate almost in half to a record low, and reduced the poverty rate of Black children and Hispanic children by 6.3 percentage points each.

Center for Law and Social Policy (CLASP), “How to End Child Poverty for Good”

At a time when inflation has made it even more difficult to afford necessities like housing, food, and utilities, the end of pandemic-era benefits has made it increasingly difficult for families to support the health and wellbeing of their children.

As monthly child tax credit payments ended and families’ incomes decreased, the child poverty rate increased, and families experienced more financial strain and higher levels of food insecurity.

Poverty is often a result of policy decisions made by lawmakers rather than choices made by individual families and communities. Our federal and state lawmakers witnessed the benefits of policies like the expanded CTC, continuous Medicaid coverage, and SNAP emergency allotments, and still decided not to extend the support or make them permanent programs.

Virginia made progress in 2022, when the General Assembly approved a state refund for a portion of the Earned Income Tax Credit (EITC) available to low-income working families. Additionally, the 2023 state budget, passed in September 2023, will provide one-time tax rebates of $200/$400 this fall to individuals or couples with taxable income. Unlike the EITC, these rebates are nonrefundable, and family size will not be factored into the payment—only marital status. Nonrefundable rebates benefit households with an income tax liability, whereas refundable rebates benefit all households. A rebate program should be well targeted and family-friendly by making rebate checks refundable and by accounting for dependents—then a wealthy individual making $300,000 a year does not receive the same amount as a working mother of 2 children making $60,000 a year. Clearly there is more that must be done to support families and address this sharp increase in child poverty.

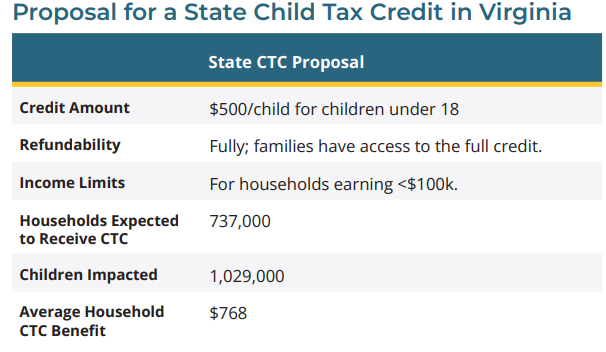

Establishing a state-level CTC would benefit more than 1 million children in Virginia. As detailed in the 2023 legislation introduced by former Senator Jennifer McClellan and Delegate Kathy Tran, the state-level CTC would create a refundable $500 child tax credit per child under 18 in households earning less than $100,000 each year.

The temporary expansion of the federal CTC demonstrated that direct cash support to families is one of the best ways to help them meet their needs and research on the federal child tax credit found that families used the additional funds to pay for food, utilities, and clothing.

The Commonwealth Institute for Fiscal Analysis (TCI), January 2023

Voices, alongside our partners at The Commonwealth Institute for Fiscal Analysis (TCI) and the Tax Fairness Coalition, will be pursuing state-level CTC legislation during the 2024 General Assembly session. Sign up for our Policy newsletter, Voices from the Capitol, to stay up to date on how you can advocate for a state-level CTC during the 2024 General Assembly session.

Over 600,000 families in Virginia currently receive the federal EITC. As of 2022, Virginia gives tax-filers an option: claim a state-level EITC up to 20 percent of a family’s federal EITC that does not exceed any income tax owed or claim a state EITC at 15 percent of the federal EITC and receive a refund of the amount that exceeds what was owed in income taxes. Making Virginia’s version of the credit refundable means that instead of just reducing how much a low-income tax filer owes without giving money back, the refundable EITC can now lead to a bigger refund or provide a refund that otherwise wouldn’t exist. The exact size of the credit depends on a tax filer’s income, marital status, and how many children they have. Check out this blog from The Commonwealth Institute (TCI) on the impact of Virginia’s EITC options.

Continuing to strengthen Virginia’s EITC to make the credit refundable at 20% of the federal credit would go even further to benefit families and provide economic relief to those who need it most. Delegate Cia Price championed a bill during the 2023 legislative session to expand the EITC to 20 percent of the federal credit, but it unfortunately did not pass. Lawmakers should prioritize bringing this bill back during the 2024 legislative session.

By targeting tax credits to low-income families, these refunds benefit Black and Brown families who have been disproportionately impacted by low wages and policies that created racial inequities in access to wealth.

As indicated in the 2023 KIDS COUNT Data Book, Black children in Virginia are more likely to live in poverty and have a parent who lacks full-time, year-round employment. Choices to expand the EITC and to target a state-level Child Tax Credit can provide more financial resources to the families who have often been left behind.

When we prioritize children and families in our policy choices, we can strengthen our future. It’s time to deepen our commitment to ensuring that families have the resources needed to thrive by offering targeted tax relief to families.

Read More Blog Posts