A Comparative Analysis of House and Senate Proposed Budgets for Economic Security: A Closer Look at Key Investments

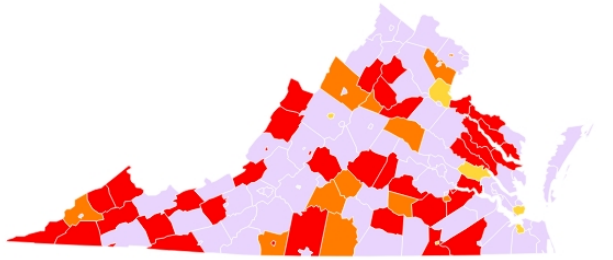

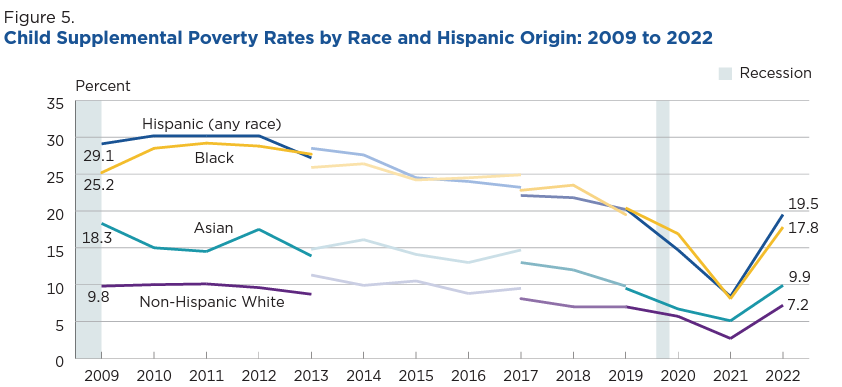

5 CommentsFamilies have been hit hard by the impact of inflation, the rising costs of utilities, food, and household necessities, and the loss of pandemic-era supports, such as the expanded federal Child Tax Credit, expanded SNAP benefits, and continuous health coverage through Medicaid. The General Assembly has the opportunity this session to invest in families and address the racial and ethnic disparities that exist in economic stability.

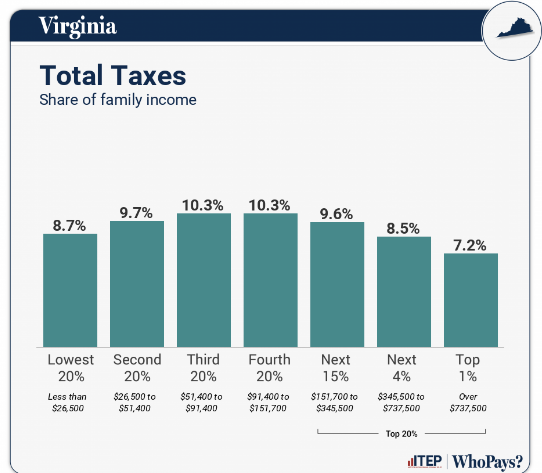

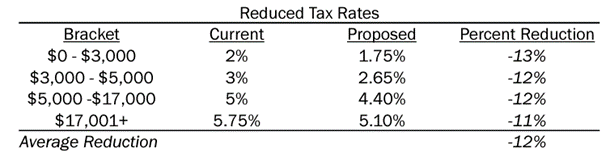

Both chambers made a critical decision to reject the income tax and sales tax proposals in the Governor’s tax package, which would have done very little for low- and middle-income families and largely benefited the wealthy. But the House and Senate budgets do not go as far as they should to meet the moment and help families make ends meet.

Investments in both House and Senate budgets:

- Summer EBT Program: The House and Senate budgets retain the Governor’s proposed funding of $5.4 million across the biennium to fund the administration of the Summer EBT program.

- Two Family/Whole Generation Pilot

- The House budget mirrors the Governor’s introduced budget, which removes funding for the Two Family/Whole Generation pilot in FY26.

- Item 331 #1s: The Senate invests $1.1 million NGF in FY26 to continue the Two Family/Whole Generation pilot program.

- Paid Family and Medical Leave

- Item 356 #4h: The House included a language only amendment, directing the Virginia Employment Commission (VEC) to update the study they completed in 2021 to include budgetary impacts of PFML for state employees, state-support local employees, and local school divisions.

- Item 356 #2s: The Senate included a language only amendment authorizing a treasury loan for the implementation of Paid Family and Medical Leave (SB373) and requires the VEC to establish and administer a PFML program beginning January 1, 2027.

- Minimum Wage Increases: The House and Senate Budgets invest $79.5 million across the biennium for the state agency cost of increasing the minimum wage to $15/hour by January 1, 2026.

Investments in the House budget:

- Virginia Commission to End Hunger (HB607): Item 1 #4h invests $51,296 across the biennium for member payments and reimbursements for their participation in the Virginia Commission to End Hunger.

- Virginia CASH Campaign: Item 331 #8h invests $1.5 million across the biennium for the Virginia Community Action Partnership contract to manage the statewide “Virginia CASH Campaign,” the state supported Volunteer Income Tax Assistance program providing outreach, education, and tax preparation services for Virginians who may be eligible for both the federal and new state Earned Income Tax Credit (EITC).

Investments in the Senate budget:

- Increased Reimbursements for School Breakfast: Item 125 #18s invests $6.7 million across the biennium to increase the state’s share of reimbursement for school breakfast from $0.22 to $0.30.

- Study of Student Food Insecurity: Item 132 #3s is a language only amendment directing the State Council of Higher Education (SCHEV) to review the status of programs that address food insecurity at colleges and universities. A report will be due to the General Assembly by November 1, 2024.

- Free Tax Filing Options: Item 260 #1s is a language only amendment directing the Department of Taxation to review free file options for individual taxpayers and develop a plan with costs for implementing a free file system in Virginia. A report will be due to the General Assembly by November 1, 2024.

Investments not included in either budget:

- Medicaid Coverage for Nutritious Food: Item 288 #64h (Del. Rasoul) / Item 288 #22s (Sen. Locke) was not included in either budget. This item would have directed the Dept. of Medical Assistance Services (DMAS) to conduct a feasibility assessment for amending the state’s 1115 waiver and the Commonwealth Coordinated Care Plus 1915(c) waiver to include coverage of food as a benefit for Medicaid members and to recognize nutrition security’s critical role as a Health-Related Social Need.

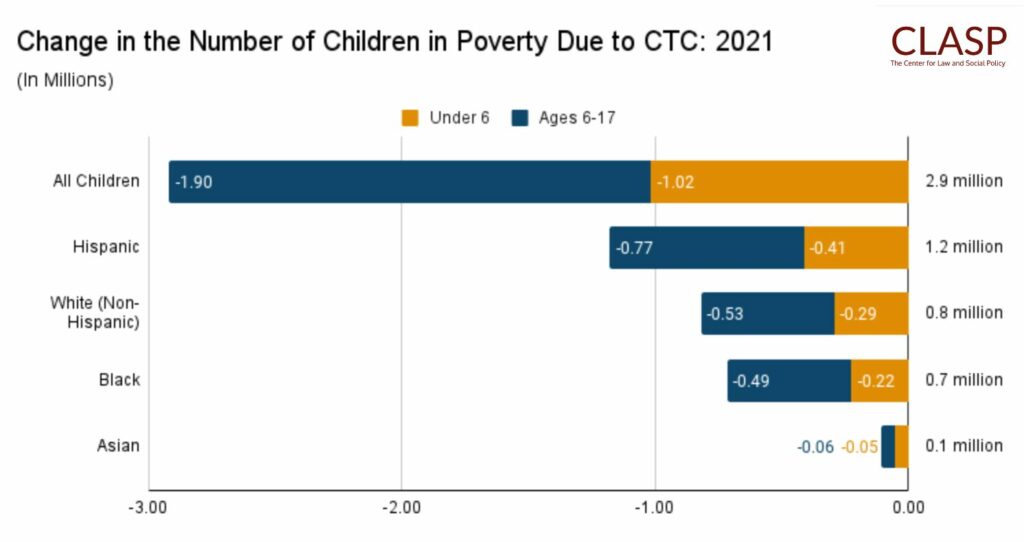

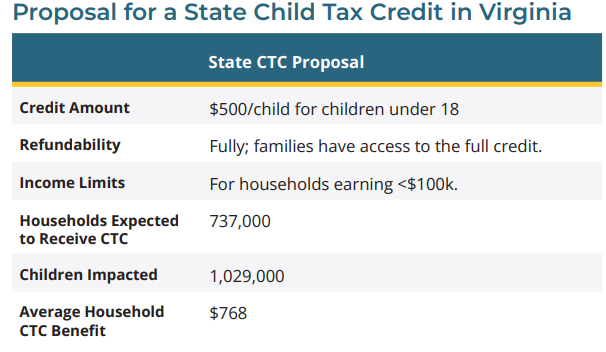

- Child Tax Credit (CTC): Item 258 #13h (Del. Tran) / Item 258 #1s (Sen. Aird) was not included in either budget. This item would have established a state-level Child Tax Credit, which would have provided a $500 tax credit per child under 18 to families making less than $100,000 adjusted gross income (AGI).

- Earned Income Tax Credit (EITC): Item 4-14 #1h (Del. Price) / Item 0 #5s (Sen. Rouse) was not included in either budget. This item would have expanded the state-level Earned Income Tax Credit, allowing low-income tax filers to claim a refundable tax credit equal to 20% of the federal EITC.

- Healthy School Meals for All: Item 125 #8h (Del. Bennett-Parker) / Item 125 #29s (Sen. Roem) was not included in either budget. This funding would have made school breakfast and lunch free for all public school students in Virginia.

- Hunger-Free Campus Grant Program: Item 132 #17h (Del. Simonds) / Item 132 #6s (Sen. Roem) was not included in either budget. This funding would have created a grant program for public colleges and universities to address student food insecurity on their campuses.

- Farm to School Program Task Force: Item 120 #3h (Del. Cousins) / Item 117 #6s (Sen. Roem) was not included in either budget. This funding would have directed the Department of Education to expand work related to farm-to-school programming by establishing the Farm to School Program Task Force.

- Paid Sick Leave (HB348): Item 349 #3h (Del. Ward) was not included in the House budget. This item would have provided funding to the Department of Labor and Industry (DOLI) to enforce and monitor Paid Sick Leave requirements across the commonwealth.

- 5000 Families Program: Item 102 #1h (Del. Coyner) / Item 102 #3s (Sen. Hashmi) was not included in either budget. This funding would have established the 5000 Families Pilot Program, which would have provided monthly rental assistance to low-income families with school-aged children.

Next Steps:

Over the next week, budget conferees will negotiate differences in the House and Senate budgets to develop a final budget proposal that will be sent to Governor Youngkin. You can urge lawmakers to support our priorities through our action alerts.