All families in Virginia deserve the opportunity to thrive, and the cornerstone of vibrant youth and adolescence is economic security. Communities should be well-resourced, having access to good schools, affordable housing and transportation, physical and mental health care, and nutritious and culturally relevant food. But centuries of policies—which were created to benefit wealthy and white residents—have perpetuated systemic racism, inequitable educational systems, and discrimination in the labor market, creating stark racial and ethnic disparities in economic stability.

As demonstrated by the 2023 KIDS COUNT Data Virginia Profile, Black children and Latino children are more likely to live in poverty than white children. This puts inequitable barriers in the lives of young people and hinders their ability to become the prosperous adults they dream to be.

During the 2024 legislative session, Virginia lawmakers must acknowledge that child poverty is a policy choice and take action to improve the lives of Virginia’s families and young people. Below are a few policies that Virginia can adopt and implement to help families make ends meet:

Virginia families are feeling the impact of inflation, the rising costs of utilities, food, and household necessities, and the loss of pandemic-era supports, such as the expanded federal Child Tax Credit, expanded SNAP benefits, and continuous health care coverage through Medicaid. According to the most recent Census Household Pulse Survey:

Economic stability not only influences the ability to feed and house your family but also determines the level of autonomy families have in their lives. When families are given direct cash resources and financial support, it supports them in making ends meet, saving for emergencies, paying off debt, education and training, and college savings for their children. Giving cash directly to families empowers parents and caregivers to invest in their children as they see fit and avoids the paternalistic nature of some public benefit programs. It demonstrates trust in families and doesn’t require them to prove that they will be “responsible” with their money.

Families should also be able to take time off work to care for a sick loved one, be with a newborn child, or care for their own medical needs without having to worry if they will be able to pay for necessities. But roughly 76% of working Virginians—especially women—are unable to do this, which is why this legislative session lawmakers must invest in programs that provide financial security. Having financial security means families can spend more time with their children and less time away from home working multiple jobs.

Budget Amendments

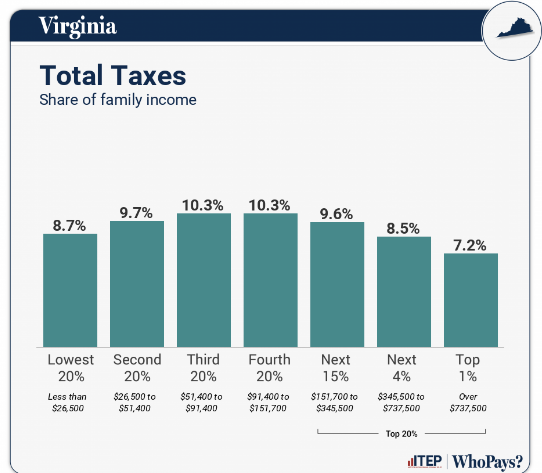

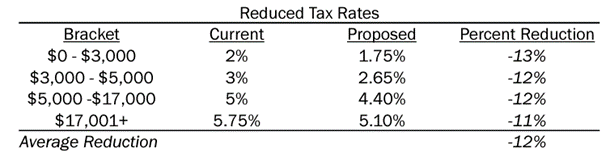

According to ITEP’s Tax Inequality Index, Virginia has the 37th most regressive state and local tax system in the country, with the wealthiest paying the least taxes as a share of their income. The current tax proposal from the Governor to lower Virginia’s income tax brackets and increase the state sales tax does very little for families with low- and middle-incomes, and largely benefits the wealthy.

The Governor’s tax package also proposes increasing the non-refundable option of the Earned Income Tax Credit from 20% to 25%, but very few households will see any help from this change. Tax credits are most effective for supporting working families when the credits are refundable, allowing families access to the full value of their credit via a cash refund. Refundability is important because it expands eligibility to households with low and moderate incomes who are left behind by non-refundable credits.

Few tax policies are conditional on providing for the needs of children or ensuring that refunds and credits are distributed based on the number of children in a home. There are proven solutions that can make an impact today and long-term—specifically, establishing a state-level Child Tax Credit (CTC) and expanding the refundable state Earned Income Tax Credit (EITC) to 20% of the federal credit.

With the expanded federal Child Tax Credit, families were able to choose how to use the money to meet their needs. More than half of Virginia families reported using the expanded CTC for food, followed by one-third who used the money to pay bills. Financial hardship creates parental stress, mental health concerns, and family instability, but family-focused policy can help impact every one of those aspects of child well–being by expanding tax credits and economic security for families.

Governor’s Budget Items

Budget Amendments

Food security is deeply connected to economic stability and community. Inequities in the food system create disparities in access to fresh, nutritious, and culturally appropriate foods and increase the disproportionate prevalence of diet-related illnesses. Between 2020-2022, 11.7% of children in Virginia experienced food insecurity. In 2023, Virginia food banks reported a 5-10% increase in demand at pantries compared to the end of 2022.

In the past several years, Virginia has: Eliminated the reduced-price school meals category; Implemented Broad-Based Categorical Eligibility for SNAP benefits; Created the Virginia Food Access Investment Fund; and allocated state funding for Virginia Fresh Match. This legislative session, Virginia can continue to build on our legislative progress by creating a universal school meals program and making additional budget investments.

Food security does not exist in a silo. It is dependent upon opportunities for economic security, collaboration with health care systems, robust food and nutrition programs, and a vibrant, affordable, and accessible food system.

Governor’s Budget Items

Budget Amendments

View Voices’ Bill Tracker to keep up with Economic Security bills that we are supporting and monitoring: https://vakids.org/our-news/blog/voices-for-virginias-children-2024-legislative-agenda

Read More Blog Posts